Torres Jewellery Scam: Investors Lose ₹13 Crore in Fraudulent Schemes

Mumbai-based Torres Jewellery has come under fire for orchestrating a major investment scam, leaving thousands of investors in financial ruin.

The company, which operated multiple showrooms across Mumbai, lured investors with promises of extravagant returns on bogus investment schemes involving moissanite stones and gems. Investors were promised a weekly cashback of 11% on the purchase value, amounting to a 400% profit annually. For example, an investment of ₹1 lakh supposedly yielded ₹11,000 weekly, totaling ₹5.72 lakh in just a year.

To attract more participants, Torres Jewellery also offered a 20% referral bonus. The firm heavily promoted these schemes through interactive sessions, prize distributions, and social media campaigns. In one instance, a video of a prize distribution ceremony was posted on their official Instagram account just a day before the scam was exposed.

The Scam Unfolds

By late December 2024, the company stopped making payments and ceased communication with investors. Thousands of people who had entrusted their savings to the firm found themselves stranded. As of January 2025, at least seven investors have formally reported losses amounting to ₹13.48 crore.

According to police reports, the scam involved additional deceitful offers. Some investors were promised 25% monthly interest on their investments, while others were offered discounts on jewelry purchases combined with weekly returns. For instance, one investor claimed they were assured a ₹10,000 discount on a moissanite pendant alongside a 6% weekly return for 52 weeks.

Police Action and Allegations Against Executives

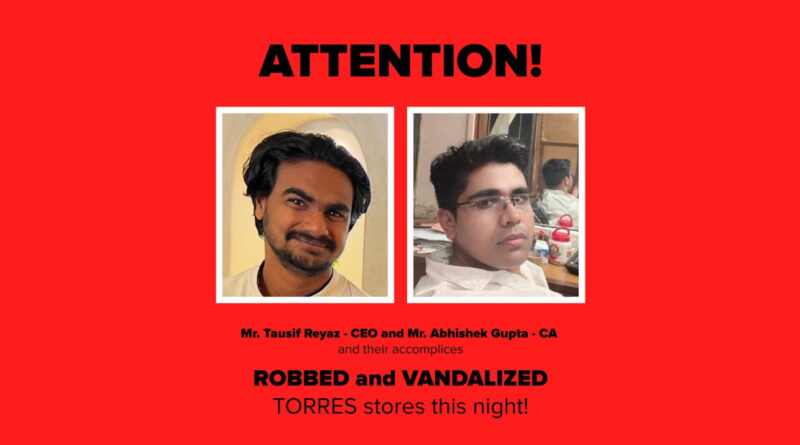

Torres Jewellery’s CEO, Taufik Riaz, and Chartered Accountant, Abhishek Gupta, are at the center of the allegations. They are accused of embezzling valuables worth ₹13.48 crore from one of the company’s showrooms. CCTV footage released by the company purportedly shows the two men stealing items and vandalizing the premises.

Police have filed cases against five top executives, including the CEO, directors, and store managers, on charges of theft, fraud, and running a Ponzi scheme. Investigations revealed that between June and December 2024, the firm promised investors weekly interest of 6%, only to default on all payments after December 30, 2024.

The company’s accounts have been frozen as part of the investigation, and its owner is reportedly absconding. While Torres Jewellery has publicly blamed its CEO and other employees for the scam, investors have gathered outside the company’s offices, demanding justice and refunds.

The Fallout

This scandal has left a trail of devastation, with many investors losing their life savings. The promise of quick and substantial returns led to widespread participation, but the reality has been a stark financial loss for countless victims.

As the investigation continues, the Torres Jewellery scam serves as a grim reminder of the risks associated with unverified investment schemes. Authorities are urging citizens to exercise caution and thoroughly investigate before investing in high-return offers.